Africa

About

"In delivering their advice and legal expertise there is always an understanding of commercial purpose and company strategy to make sure our objectives are met in the widest sense."

Chambers Global, Africa-wide, 2021

White & Case lawyers have guided clients doing business in Africa for more than 45 years. We work with both international clients investing in Africa and Africa based clients on some of their most significant, complex and high-value matters. We support our clients in Africa with lawyers from across our network of offices, and especially those based in London, Paris, the UAE and Washington DC and from within Africa in Johannesburg and Cairo.

Clients doing business in Africa benefit from our:

- Deep regional experience in all major practice areas: Disputes, Capital Markets, Debt Finance, Project Development & Finance, Private Equity & M&A, Restructuring & Insolvency and Compliance.

- Market leading expertise in key industries and sectors: Financial Institutions, Infrastructure, Telecommunications, Mining & Metals, Manufacturing & Industrial, Energy, Power and Sovereigns

- Longstanding local presence and dedicated, diverse teams of experienced lawyers: Clients value our intimate knowledge of Africa's markets – drawn from more than 150 lawyers and experience from having worked in strength across English, French, and Portuguese speaking jurisdictions.

Download our 2023 Annual Review here

Visit our latest Africa Focus edition

View our Thought Leadership here

AWARDS AND RECOGNITION

Band 1: Capital Markets

Chambers Global, Africa-wide 2023

Band 1: Dispute Resolution

Chambers Global, Africa-wide 2014 – 2023

Band 1: Projects & Energy (Oil & Gas)

Chambers Global, Africa-wide 2023

Band 2: Corporate M&A and Private Equity

Chambers Global, Africa-wide 2023

Band 2: Projects & Energy (Mining and Minerals)

Chambers Global, Africa-wide 2023

Africa Law Firm of the Year: Corporate M&A and Private Equity

Chambers Global, Africa Awards 2023

Tier 1: Emerging Markets

Legal500 2023

Tier 1: Foreign Firms in Ghana

Legal500 2023

Tier 1: Foreign Firms in Morocco

Legal500 2023

Tier 2: Foreign Firms in Algeria

Legal 500 2023

Experience

Nacala Project, Mozambique

Representation of Vale regarding the financing of the Nacala Project, including the construction of a new 201-km rail line to connect the Moatize mine in Tete to the existing railway line in Malawi at Nkaya Junction; the rehabilitation of the existing line in the Malawi rail network and in Mozambique between Nkaya and Monapo, for an approximate length of 682 kms; the construction of a new 29-km branch line, which will connect the existing railway line; and the port and the construction of a new coal port terminal in Nacala-à-Velha.

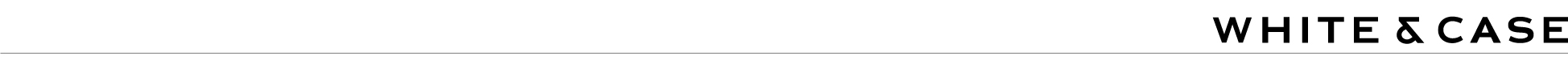

Ciprel IV power project, Côte d'Ivoire

Representation of CIPREL, an Ivorian independent electricity producer controlled by Eranove, in the financing of both sub-phases of the fourth-phase expansion of its power unit turbine, Tranche A (a 111 MW gas-to-power unit) and then Tranche B of such expansion (a 111 MW combined-cycle expansion amounting to €200 million) in Côte d’Ivoire. This transaction was named "Best Sustainability Deal of the Year in Africa" by EMEA Finance in 2016.

Petrobras Oil & Gas, Nigeria

Representation of the mandated lead arrangers in connection with a US$750 million reserve-based lending facility Petrobras Oil & Gas B.V. for the development of offshore oil fields in Nigeria.

Dakar-Diamniadio toll road and its extension, Senegal

Representation of the project company formed by Eiffage in its offer to the Republic of Senegal for the concession, financing, building and operation of the 32-km Dakar-Diamniadio public-private partnership toll road project in Senegal, transaction which was named "Africa Road Deal of the Year" by Project Finance 2010. In 2015, we represented the project company in a new section to connect this toll road to the new Blaise Diagne international airport, the transaction which was named "Best Infrastructure Deal in Africa" by EMEA Finance 2015.

Bauxite Mine, Guinea

Representation of BNP Paribas, Crédit Agricole, IFC, ING, Natixis, OPIC, Société Générale and two Guinean banks in the financing of Compagnie des Bauxites de Guinée's Sangaredi bauxite mine expansion in the Republic of Guinea. The financing is part of the largest foreign investment in Guinea in recent years, with a debt in the hundreds of millions of dollars committed for the mine expansion. Awarded "African Mining Deal of the Year" by IJGlobal Awards 2016.

GMTN Programme, Nigeria

Representation of the Republic of Nigeria in the establishment (and upsize) of a US$1.5 billion GMTN Programme and subsequent Reg S/144A offering of US$1 billion 7.875% notes due 2032 and a further US$500 million tap issuance.

Tender offer and notes issuance, Côte d’Ivoire

Representation of Deutsche Bank, Natixis, Standard Chartered Bank, J.P. Morgan and BNP Paribas as joint lead managers and dealer managers on the tender offer in respect of Côte d'Ivoire's 2024 and 2032 notes and the offering of US$1.25 billion amortizing notes due 2033 and €625 million notes due 2025.

Eskom GMTN Programme, South Africa

Representation of Eskom Holdings SOC Limited, as issuer, in the establishment of its US$4 billion Global Medium Term Note Programme and the inaugural issuance of US$1 billion 6.750% notes due 2023, under the Programme. We subsequently advised on the update of the programme and the issue of US$1.25 billion 7.125% Reg S/144A Notes due 11 February 2025.

Victory in long-running International Chamber of Commerce arbitration

In a politically charged US$1 billion dispute relating to public works that had remained unpaid for 30 years, we obtained an award of €550 million, plus costs, for Commisimpex against the Republic of the Congo in 2016. France's highest court then upheld the award, ending the substantive phases of a €1 billion worldwide dispute spanning more than three decades.

Telecommunication financing and refinancing, DRC, Gambia, Sierra Leone and Uganda

Representation of Deutsche Bank AG in relation to a US$150 million term loan facility to an African telecommunications company as borrower. The facility was supported by security in a number of different jurisdictions, including DRC, Gambia, Sierra Leone and Uganda. We are also currently acting for the lenders on a subsequent US$200 million refinancing.

Rand Merchant Insurance Holdings Limited

Representation of Rand Merchant Insurance Holdings Limited in the ZAR 9 billion funding of its acquisition of 30% of Hastings PLC. The funding encompassed notes and preference shares issued pursuant to its domestic medium term note program and a term loan.

Digital Terrestrial Television network solution, Ghana

Representation of the Ghanaian Ministry of Communications in an ICC arbitration under Ghanaian law concerning the supply and installation of a Digital Terrestrial Television network solution in Ghana.

HTN Towers, Nigeria

Representation of the seller, HTN Towers plc (a portfolio company of Helios Investment Partners), in relation to a sale of HTN to IHS Nigeria.